What Are the Key Changes in 2025 Trade Policies for Importing from China to the USA?

How Will Tariffs and Duties Be Adjusted in 2025?

Big changes loom in 2025 for what you bring in from China to the USA. The United States Trade Representative (USTR) crew are revising Section 301 tariffs, which are essentially Chinese import surtaxes. Some of them are sticking around, but others are coming in, especially on trendy items like electric cars, batteries, and computer chips. These levies started at 25% in 2024 on some products, including face masks, and shot up to 50% in 2026. Medical gloves? They’re being levied a 50% fee in 2025 and a whopping 100% in 2026.

Why? It’s about making American businesses strong and keeping China’s games in check. Don’t worry, however—some items get a break with tariff exclusions being made available through August 31, 2025, so businesses don’t end up paying more for everything. Check USTR‘s website or the Harmonized Tariff Schedule (HTS) to know what’s what. It’s like a treasure map for your import costs.

What Regulatory Shifts Should Importers Be Aware Of?

It’s not just tariffs—new rules are tightening up. The Uyghur Forced Labor Prevention Act (UFLPA) leaves no stone unturned in making sure that no products are being produced in regions containing forced labor. The U.S. Customs and Border Protection (CBP) is vigilant, so you have to prove your product is clean with heaps of paperwork containing your supply chain. No proof? Your stuff might get stuck at the border.

Plus, green rules are tightening up. If you’re bringing in electronics or clothes, you might need to show they’re made eco-friendly or report their carbon footprint. It’s like a green sticker for your goods!

Are There New Compliance Requirements for US-Based Importers?

Yes, there’s new homework for importers. Know Your Supplier (KYS) rules mean you gotta check your Chinese suppliers are legit. You need stuff like factory audits, business licenses, and proof of where your goods are made. CBP wants all this to make sure everything’s on the up and up during customs checks.

How Can You Navigate the Import Process from China to the USA?

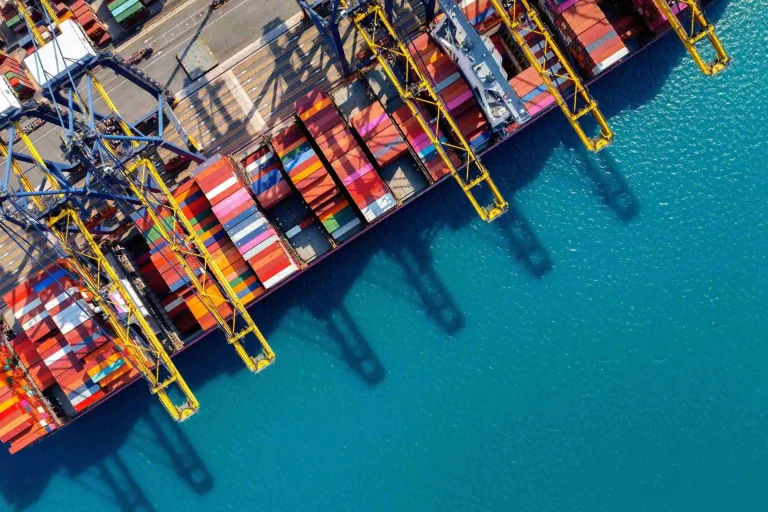

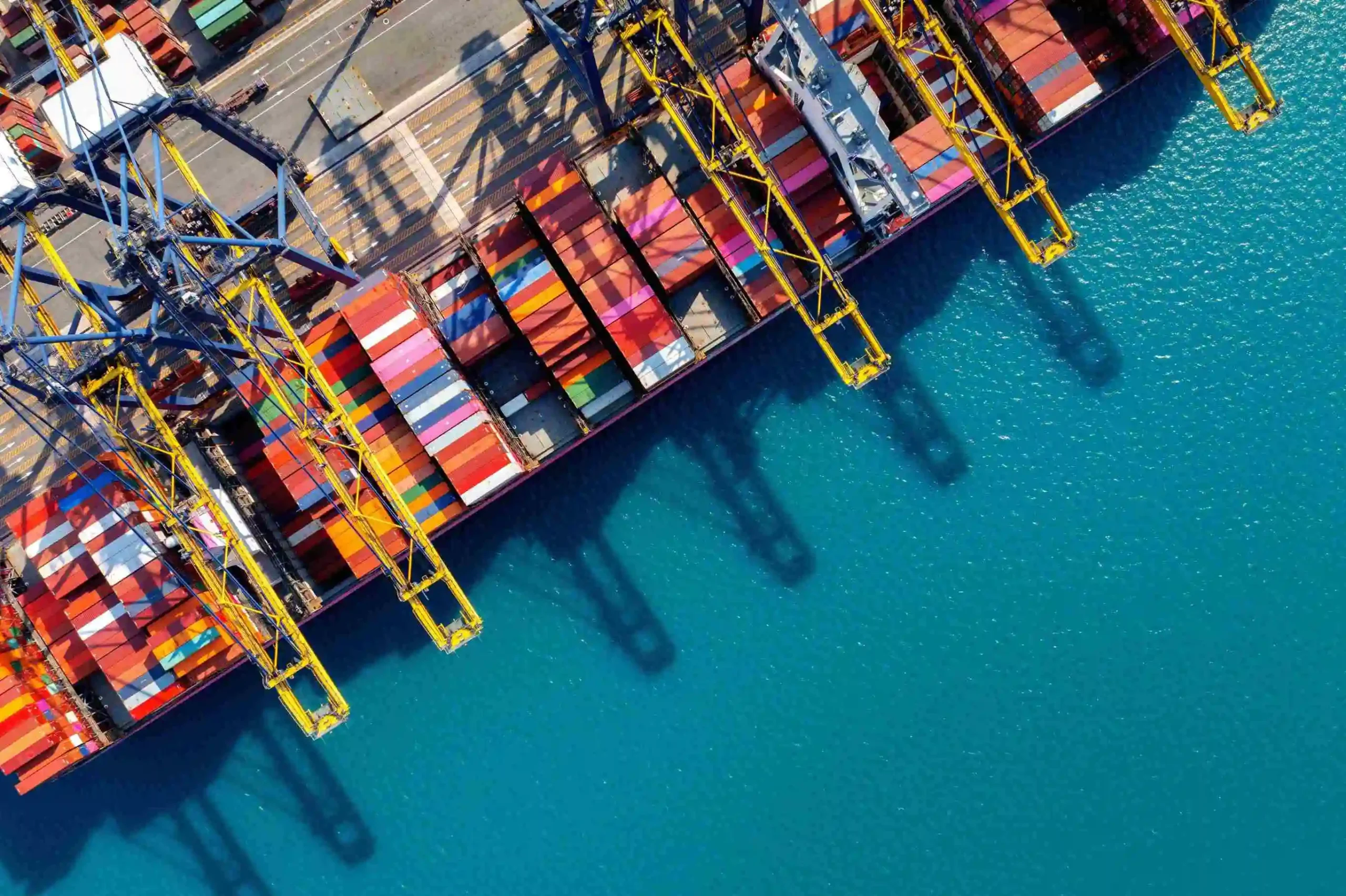

What Are the Main Steps in the Freight and Shipping Process?

Bringing stuff from China to the USA is like a big adventure with a few key steps:

Choosing Between Sea Freight and Air Freight

You can send goods by sea or air. Sea freight is cheaper for big loads but super slow—25 to 40 days depending on busy ports or routes. Air freight is zippy, taking 7 to 10 days, but it costs a ton more per kilo.

Understanding Customs Clearance Procedures

Customs is essentially the guardian of your merchandise. You need to have on hand items like a commercial invoice, packing list, bill of lading (or airway bill for airline shipping), arrival notice, and CBP Form 7501. You’ve got to have the correct HTS codes to calculate your tariffs so you don’t over- or underpay. If your product needs special permits (e.g., FDA for food products), have those available beforehand, or your shipment’s gonna sit at the dock.

Managing Documentation and Invoicing

The paperwork’s a big deal! Your commercial invoice needs details like what you’re shipping, how many, how much each cost, total value, Incoterms (like FOB or CIF), and who’s buying or selling. Mess up, and customs might hold your goods or slap you with a fine. A pro procurement agent can keep things smooth and follow both Chinese and U.S. rules.

How Long Does It Take to Import Goods from China?

Shipping time depends on how you send it:

- Sea freight: 25–40 days

- Air freight: 7–10 days

- Express courier: 3–5 days

These don’t count time to make the goods, move them around in China or the USA, or deal with customs delays or inspections.

What Costs Should You Expect During the Shipping Process?

Here’s what you’ll pay for:

- The stuff you’re buying

- Freight costs (sea or air)

- Insurance to keep it safe

- Customs duties and taxes

- Fees for port handling

- Trucking to move it inland

- Storage if it sits at the port

Extra costs can pop up if customs inspects your goods or if you don’t clear them fast enough (that’s called demurrage). Plan ahead to avoid surprises!

Which Strategies Help Reduce Risks When Importing from China to USA?

How to Select Reliable Suppliers in China

Finding a trustworthy supplier is key. Check their business license on China’s National Enterprise Credit Information Publicity System—it’s like a report card for companies. Ask for samples before ordering a ton. Use trade platforms that check suppliers’ track records, or visit factories yourself. Hiring a local agent to snoop around helps make sure they’re legit and make good stuff.

What Quality Control Measures Can Be Implemented?

You gotta make sure your goods are top-notch. Pre-shipment inspections are a must—someone checks if your products match what you ordered before they leave China. Third-party pros can look at packaging, amounts, labels, and materials, and even test how things work. Keep doing random checks on later orders to make sure the quality stays awesome.

How Can You Avoid Common Pitfalls in International Trade?

New importers trip up a lot. Watch out for:

- Mix-ups on what you’re ordering because of language or culture gaps

- Forgetting to agree on Incoterms (like who pays for shipping)

- Using wrong HTS codes, which means surprise fees

- Skimping on insurance and losing money if goods get wrecked

- Not knowing customs rules

- Getting scammed on payments

- Late production messing up your schedule

- No backup plan for shipping hiccups

A good procurement agent can dodge these traps by talking to suppliers like a pro and keeping everything legal.

Why Choose Sangni as Your Procurement Agent When Importing from China?

Who We Are and What We Do at Sangni

Sangni‘s a super helpful team in China that makes importing a breeze. We’re like your best buddy for getting stuff from China to the USA, handling everything so you don’t stress.

How Our Procurement Services Simplify Your Import Journey

Supplier Sourcing and Evaluation

We find you awesome suppliers from our big network. We check their factories for skills, prices, certifications (like ISO or BSCI), and how they’ve done before. You get a clear report to pick the best ones without guessing.

Order Management and Quality Inspection

We watch your orders like hawks, from samples to big batches, making sure they’re done on time. Our quality team checks everything before it’s made and again before it ships.

Logistics Coordination and Customs Support

We book the best sea or air freight deals for you. Our team gets all the paperwork right and helps with customs in China and the USA, so your stuff zooms through ports without getting stuck.

Why Clients Trust Sangni for Their China-to-USA Imports

People love us because we’re upfront about costs—no sneaky fees! We’re like your China office, dealing with suppliers and keeping your interests safe. With tons of shipments handled, we know how to make importing easy and reliable.

FAQ

Q: What documents do I need to import from China to the USA?

A: You need a commercial invoice, packing list, bill of lading or airway bill, arrival notice, CBP Form 7501, and special licenses (FDA for food, etc.).

Q: Sea freight or air freight is better for importing.

A: Air freight is faster but more costly; sea freight is cheaper for bulk shipments but takes longer. Pick based on how quickly you need it vs. your budget.

Q: Do I need an import license for the USA?

A: Most products do not need a license, though products like firearms or medical devices need permits from authorities like the FDA or ATF.

Q: How do I know if my Chinese supplier is legit?

A: Check their license on official databases, get audits, ask for references, or use agents like Sangni to check their export history.

Q: What mistakes do new importers make?

A: They mess up product details, use wrong HTS codes, skip insurance, forget Incoterms, or don’t plan for delays or supplier issues.